Estimated reading time: 4 minutes

From economic worries to inappropriate home pricing, numerous factors can influence a homebuyer’s decision not to take the plunge into lake homeownership, resulting in extended “days-on-market” and home seller disappointment. However, according to the recent 2025 Profile of Home Staging survey by the National Association of REALTORS®, a visually appealing home can lead to a faster sale and a higher sales price.

Home Research and Inflated Buyer Expectations

From homebuyer how-to and best practices to lake home styles, today’s buyers are exposed to a tremendous amount of information that helps them become well-informed and savvy consumers. However, in addition to consuming valuable educational information, homebuyers are often inundated with content depicting picture-perfect homes, leading to unrealistic expectations of how properties should look versus the realities of how houses are presented on the market. According to the 2025 Profile of Home Staging survey:

- 58% of respondents said that buyers were disappointed by how homes looked compared to homes they saw on TV shows.

- 73% of respondents said that TV shows that display the buying process impacted their business by setting unrealistic expectations or increasing expectations.

The Home Staging Advantage

Visual appeal and how your lake home is presented are important when selling. Today’s homebuyers are savvy and often have expectations of how their future home should look and function. While updating your house to meet the meticulously styled standards seen on TV shows is usually unrealistic, staging your property to appeal to the average homebuyer has its advantages.

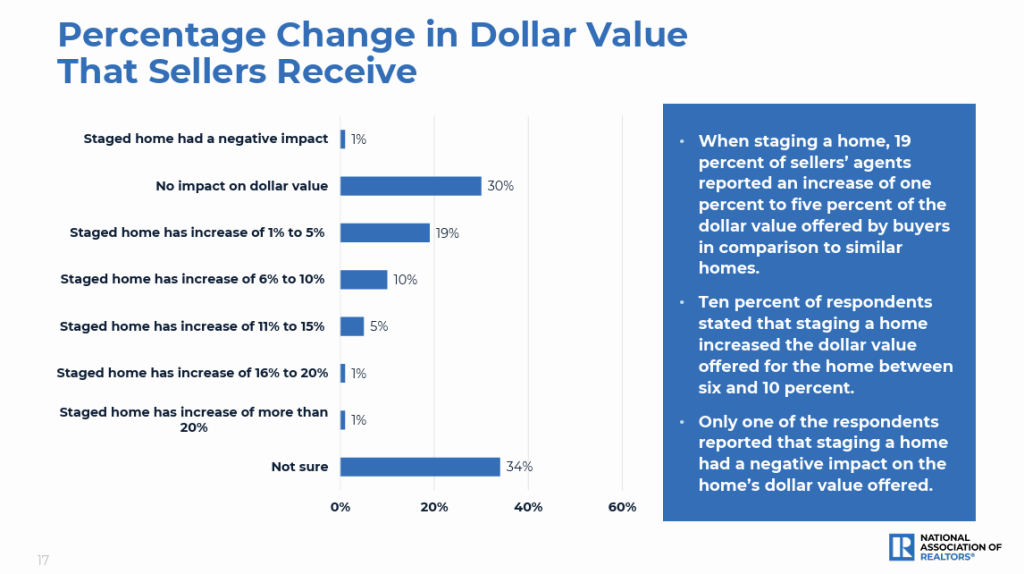

Home Value Boost

Nineteen percent of sellers’ agents reported an increase of up to 5% in the dollar value offered when compared to similar, unstaged homes. Moreover, 10% of agents said the dollar value offered increased by 6% and 10%.

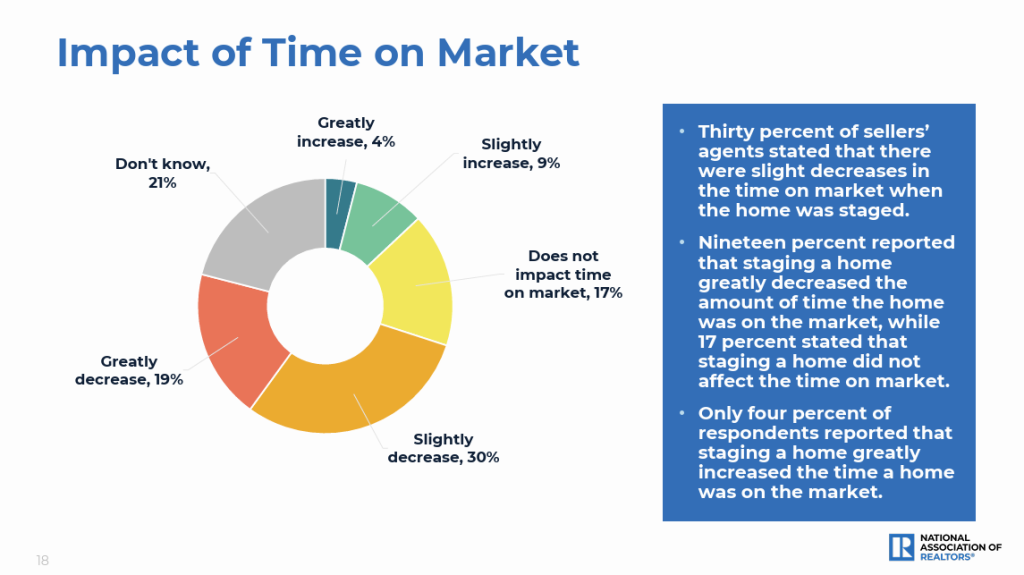

Speed of Sale

Roughly half of the real estate professionals surveyed mentioned that staged homes tend to sell faster than unstaged homes. 30% of sellers’ agents reported slight decreases in the time on market for staged homes, and 19% stated that staging a home greatly decreased the amount of time on market.

While some sellers hire professionals, many agents do offer staging services. It’s also common for homesellers to do the staging themselves. Whichever route you decide to take, when you’re ready to sell, staging can help your home sell more quickly and might even help you get a higher price.

Want to view more data on home staging? Download the 2025 Profile of Home Staging report.

Ready to sell your lake home? Check out 11 Things To Do Before Listing Your Lake Home.