Estimated reading time: 5 minutes

When buying home insurance, many homeowners overlook the possibility of flooding. However, assessing flood risk is crucial for all homeowners, especially those at the lake. According to Realtor Magazine, almost 6 million homes and commercial buildings in the U.S. are at high risk for flooding. In fact, according to the Federal Emergency Management Agency (FEMA), flooding is the most common natural disaster in the country. Even if a hurricane doesn’t hit your home, even an inch of flooding can cause damage to your property and result in mold. These repairs are not inexpensive either. The average annual damage cost in the country due to flooding is $2 billion. Given these consequences, knowing your risk based on the flood zones, preparing for these risks, and protecting your lake house are paramount.

Flood Zones 101

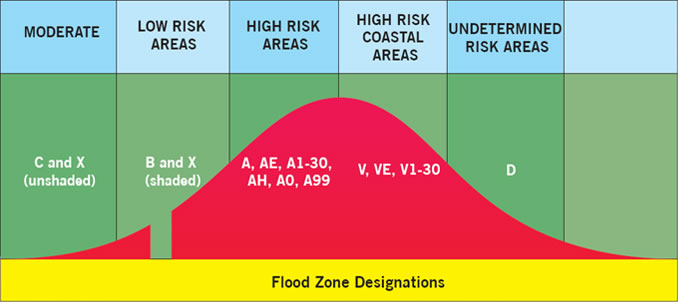

If you’re a first-time homeowner, the concept of flood zones might be new. Essentially, flood zones are different areas distinguished by their risk of flooding. There are four flood zone classifications:

- A – high risk, usually along bodies of water

- B or Shaded X – moderate risk

- C or Unshaded X – low risk

- V – a high-risk coastal area

In fact, in an A or V zone, flood insurance is required due to the risk level. Oftentimes, lake houses fall into zone A. However, this isn’t always the case. Your zone could also change over time. Due to the changing environment and warming atmosphere, more storms and hurricanes are possible. The result is that some homes previously in a low-risk flood zone are now higher risk. Your zone could also change due to nearby construction or recurring weather-related factors. Since flood zones are not static, it’s important to stay informed about your home’s risk.

Flood Zones and Lake Houses

No home is free from flood risk, so it’s best to stay vigilant no matter your residence. However, lake homes are at increased risk due to their proximity to a body of water. While most lake houses are situated on controlled water and elevated enough to prevent flooding, hazards can still occur. Due to the surrounding water, it’s best practice to investigate your flood risk and need for insurance.

Is Your House in a Flood Zone?

Thankfully, online resources can help you determine your house’s risk of flooding. With many of these free tools, you simply type in your address to receive a wealth of helpful information: your flood risk, the proportion of properties at risk in your county, the history of floods in your area, and recommendations. In addition to revealing this information within seconds, it includes climate data and risks of rainfall and flooding — both of which are not currently included on federal maps. Federal maps also tend to underestimate the number of homes that are actually in flood zones. If you want a more individualized approach to assessing your flooding risk, you can also hire a surveyor to evaluate your home. They will take more personalized features into account, such as the age of your home.

Protecting Your Property from Flooding

If you’re in a flood zone, there are several precautions you can take. First, consider getting flood insurance from the National Flood Insurance Program or a private insurer. Since the typical homeowner’s insurance does not cover flood damage, you’ll need to buy flood insurance separately. According to FEMA, flood insurance typically costs $898 per year, but this is very little compared to the cost of repairing flood damage. However, this cost can differ depending on your home’s elevation.

In addition to purchasing insurance, there are several solutions to control flooding on your own. Sealants, rain barrels, and sandbags are less expensive options, while installing a sump pump is a more pricey way to manage excess water.

Although proximity to water is a huge selling point of owning a lake home, it also comes with increased flood risk. Know the flood zones, and prepare accordingly!

For more lake home improvement tips, visit Lake Homes Lifestyles.

This article was originally published on August 3, 2020.