By Bill Brown, 2017 President of the NATIONAL ASSOCIATION OF REALTORS®.

Learn more about Bill on NerdWallet’s Ask an Advisor

The mortgage interest deduction and the state and local property tax deduction are probably the best-known tax incentives for homeownership and real estate investment.

That’s no surprise. Roughly nine out of 10 home buyers borrow money to buy a home, meaning they likely pay some form of mortgage interest. And property taxes are a near-universal expense for homeowners.

Both deductions are crucial to making homeownership possible for the average buyer.

But there are other real estate-related tax incentives that might not be as familiar.

Capital gains exclusion

All homeowners hope their property will appreciate.

The flip side is that anyone selling an asset that has gone up in value may get hit with a tax bill for the profit, also known as the capital gain. Thankfully, homeowners have some help in their corner.

An individual selling his or her principal home can qualify for an exclusion of up to $250,000 in capital gains, and married people who file jointly may qualify for an exclusion of up to $500,000.

There’s no need to report gains up to these limits on a tax return.

To take the exclusion, sellers must pass the IRS’ ownership and use test, but it’s fairly straightforward.

Essentially, they must own the property and have used it as a primary residence for a total of two out of the five years preceding the sale. Even if owners currently rent the property and depreciate it — as we’ll discuss shortly — they might still meet the use and ownership test and qualify for the exclusion. And even if sellers haven’t lived in the home during the past five years, they might qualify for a partial exclusion.

That’s a big help, as well as a recognition of the fact that millions of Americans depend on their home to build wealth throughout their lives.

1031 like-kind exchanges

The “1031 like-kind exchange” sounds like it’s ripped right from an accountancy textbook, but it’s actually fairly easy to understand.

Let’s say a person owns a single-family, detached rental home as part of an investment portfolio. If the home appreciates, the owner will likely owe capital gains taxes in the event of a sale — unless he or she uses the proceeds to buy a condominium in a market with higher rents.

Because the single-family home and the condo are both investment properties, tax law treats them as “like kind.” And because this transaction is a “like-kind exchange,” the owner won’t pay capital gains tax until he or she sells the new property.

This gives investors an incentive to put any realized gains back into the economy rather than pocketing them. And it’s a big deal: Major real estate investors and mom-and-pop investors alike can benefit.

Depreciation on rental property

Homeowners who rent a portion or all of their property might be able to “depreciate” that asset, which means deducting some of the cost of the property each year on their tax return.

That could result in a significant income tax deduction.

If you do earn money on the sale of your home after depreciation is taken into account, you’ll generally owe tax on the depreciated portion at the 25 percent “depreciation recapture” rate.

Any other gains will be taxed as capital gains.

Changes may be coming

For more than a century, the United States has recognized the benefits of homeownership and real estate investment.

It strengthens communities and helps individuals grow nest eggs for themselves. However, Congress is considering tax reform proposals that could have sweeping implications for real estate incentives.

That’s something to keep an eye on.

Everyone’s tax situation is unique. Before you count on any of these incentives, you may want to talk with a tax professional. But if you’re ready to take the plunge into homeownership or real estate investment, tax benefits — some obvious and others perhaps less so — are out there.

Bill Brown is the incoming president of the National Association of Realtors.

The article Deductions Aren’t the Only Way to Save on Real Estate Taxes originally appeared on NerdWallet.

NerdWallet is a Lake Homes Realty / LakeHomes.com content partner providing real estate news and commentary. Its content is produced independently of Lake Homes Realty and LakeHomes.com.

Hiring a cleaning service is absolutely essential before renting out your vacation home. You want to make sure all of your bases are covered and your home is spick and span before anyone stays there.

Hiring a cleaning service is absolutely essential before renting out your vacation home. You want to make sure all of your bases are covered and your home is spick and span before anyone stays there.

Many lake home and vacation homeowners

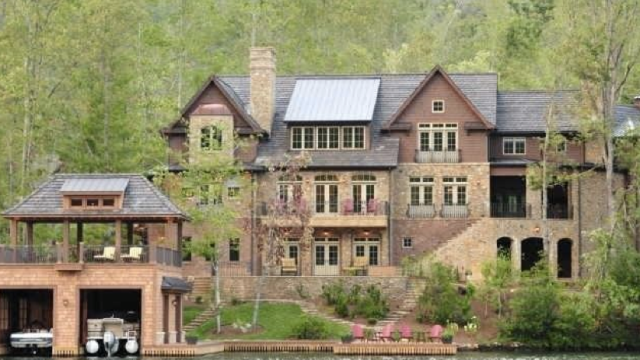

Many lake home and vacation homeowners  One of the key advantages to owning a vacation home is that the owner may be eligible to deduct mortgage interest payments when filing taxes, if it is used as a second home. In the case of renting out a vacation home then you may be able to deduct expenses related to personal usage and depreciation on the property.

One of the key advantages to owning a vacation home is that the owner may be eligible to deduct mortgage interest payments when filing taxes, if it is used as a second home. In the case of renting out a vacation home then you may be able to deduct expenses related to personal usage and depreciation on the property. You can attract more affluent clientele by retrofitting your second property to look more modern and eco-friendly, which also allows you to take advantage of government tax credits and incentives for going green. You will at least want to clean up the property and move personal items into storage.

You can attract more affluent clientele by retrofitting your second property to look more modern and eco-friendly, which also allows you to take advantage of government tax credits and incentives for going green. You will at least want to clean up the property and move personal items into storage.